A Master of Business Administration (MBA) is one of the most sought-after master’s programs both in India and globally. Students from any discipline can pursue this program after completing their undergraduate studies. The duration of the MBA Specializations is two years and is available through regular, online, and distance learning modes from top universities.

The MBA program aims to provide a thorough understanding of contemporary business management and administrative practices used in the industry. It is considered a gateway to a wide variety of management positions across different sectors. The curriculum focuses on equipping students with business management skills necessary for success in the ever-changing business environment. It includes various industry-relevant specializations that give students a detailed knowledge of specific areas.

Given the high demand for MBAs in India, it has become a common qualification, making it challenging for graduates to differentiate themselves in the job market. This saturation has led to a highly competitive job environment, where students either struggle to find suitable jobs or face difficulties in securing promotions within their current organizations.

To address this, it is crucial for students to pursue courses and specializations that help them stand out in the industry, securing relevant positions and achieving faster promotions and appraisals in their careers.

1) Executive MBA

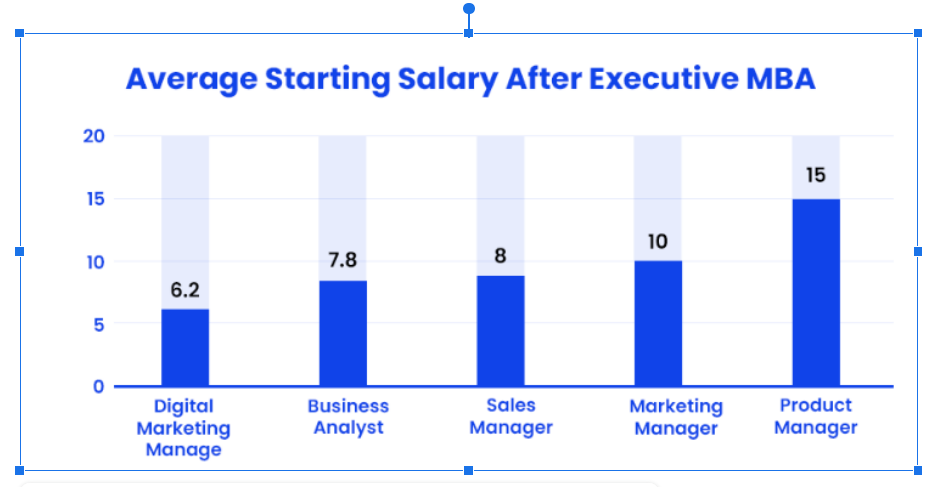

This program caters to working professionals who have begun their careers in business organizations immediately after earning their undergraduate or MBA degrees. Tailored specifically for those with industry experience, this program aims to enhance their knowledge and skills in business management.

Professionals seeking to stay current with the latest advancements in business management often find that this program helps them secure frequent promotions in their current roles. It offers an opportunity to deepen their understanding of business management and administration.

The Executive MBA for Working Professionals is available through some of India’s top universities and business schools, including the prestigious IIMs. Importantly, this program allows professionals to continue working without needing to take a career break.

Participants can choose to enroll in this program through either a hybrid or online mode. In the hybrid mode, classes are held on weekends and holidays at the university or its designated centers, allowing professionals to attend without disrupting their work schedule. In the online mode, professionals can attend live, interactive classes via the university’s advanced Learning Management System, led by top faculty members, without needing to visit the campus.

Additionally, examinations for the online mode are conducted remotely using E-Proctored Software, whereas hybrid mode students are required to visit the university for their exams. This flexible approach ensures that working professionals can balance their education with their career commitments.

Working professionals interested in this program should have 2 to 3 years of experience in the relevant industry. The program provides a variety of specializations that impart industry-specific knowledge and skills.

This allows participants to enhance their existing understanding of the business environment, making them more competitive within the industry.

After completing the program, professionals can expect to receive frequent promotions within their current company or transition to a new organization with a higher managerial role and improved compensation.

Job Profiles

| Job Profiles | Average Salary |

| Marketing Director | INR 26 LPA |

| Chief Finance Officer | INR 13 LPA |

| HR Director | INR 29 LPA |

| Product Development Manager | INR 15 LPA |

| Chief Operating Officer | INR 14 LPA |

2) Doctorate in Business Administration

A Doctorate in Business Administration (DBA) is a unique program designed to provide advanced knowledge and expertise in business management. This doctorate-level program is tailored for professionals working at executive and senior levels within organizations.

The DBA program is aimed at seasoned professionals seeking to deepen their understanding of business theory, research methodologies, and strategic management practices applicable to real-world challenges. Unlike a traditional PhD in Management, which focuses on academic and theoretical research, the DBA emphasizes practical knowledge and its application to complex business problems.

This program aims to enhance the managerial skills of experienced professionals and contribute to applied business knowledge. The curriculum covers a broad range of topics, including organizational behavior, strategic management, marketing, finance, and entrepreneurship. Students learn to critically analyze complex business issues, formulate innovative solutions, and make informed strategic decisions.

Upon completion, graduates can use the “Dr.” prefix, signifying one of the highest professional designations. This enhances their reputation within the industry, symbolizing intelligence and professional competence. As a result, DBA holders become highly eligible for top roles in diverse business landscapes.

Job Profiles

Upon completing the Doctorate of Business Administration, students can pursue several top job roles, including:

| Job Roles | Average Salary |

| Business Consultant | INR 15.47 LPA |

| C-Suite Executive | INR 20.81 LPA |

| Organizational Development Manager | INR 17.32 LPA |

| Strategic Planner | INR 11.00 LPA |

| Project Manager | INR 17.25 LPA |

3) PhD in Management

Students seeking to delve into academic research in business management can enroll in a PhD program in Management after completing their Master of Business Administration (MBA). This doctoral program, spanning 3 to 5 years, provides comprehensive research opportunities in the field of business management.

Building on the foundational knowledge gained during their MBA studies, students in this program explore advanced theories, methodologies, and empirical research across various management disciplines. Key areas of study include organizational behavior, strategic management, and marketing. Notably, an online doctoral degree option is also available.

The program’s curriculum is rigorous, featuring extensive coursework and original research culminating in a doctoral dissertation. This process sharpens students’ critical thinking, analytical, and problem-solving skills, enabling them to contribute new insights to the management field.

Additionally, students have opportunities to engage with industry leaders, participate in conferences, and publish their research in academic journals. These activities enhance their credibility and expand their professional networks.

Graduates of the program earn the prestigious “Dr” designation, opening doors to diverse career paths in academia, business consulting, and marketing research. In academic roles, they can develop new theories and methodologies that address the complexities and challenges of business management.

Overall, this PhD program promotes holistic development, enhancing students’ research capabilities and deepening their expertise in management studies.

Job Profiles

After completing a PhD in Management, numerous career opportunities open up. Below are some of the leading career options available to PhD graduates in this field:

| Job Profiles | Average Salary |

| Business Professor | INR 10.00 LPA |

| Product Manager | INR 17.00 LPA |

| Research Associate | INR 5.40 LPA |

| Management Consulting | INR 25.00 LPA |

4) Chartered Financial Analyst (CFA)

After completing a Master of Business Administration (MBA), students aiming to expand their career prospects in financial management might consider enrolling in a Chartered Financial Analyst (CFA) program.

This program typically spans 2 years but can be extended to a maximum of 4 years, depending on the institution offering the course. The CFA program, administered by the CFA Institute, is a globally recognized certification in the field of finance.

While working through the CFA curriculum, students can build upon the knowledge gained from their MBA studies to deepen their expertise in investment management, financial analysis, and portfolio management.

The CFA curriculum is structured into three levels, each designed to develop specific skills and knowledge in finance. Topics covered include quantitative methods, economics, corporate finance, equity and fixed-income analysis, derivatives, and alternative investments, providing a comprehensive foundation in financial management.

In the finance sector, earning a CFA designation represents a pinnacle of professional excellence and a commitment to high ethical standards and superior performance.

Completing the CFA program across its three levels develops advanced analytical skills, enhances decision-making capabilities, and provides a deep understanding of global financial markets. It prepares individuals for leading roles in fields such as investment banking, asset management, equity research, and risk management.

Globally recognized, the CFA credential opens up both domestic and international career paths in financial management. The program equips students with advanced financial knowledge, demonstrating their ability to handle complex financial challenges and access a broad array of opportunities within the finance industry.

Job Profiles

Upon completion of the CFA program, students are presented with a diverse array of career opportunities. Here are a few of the potential paths available:

| Job Roles | Average Salary |

| Portfolio Manager | INR 17.33 LPA |

| Risk Manager | INR 13.71 LPA |

| Investment Banker | INR 17.00 LPA |

| Private Wealth Manager | INR 7.40 LPA |

5) Certified Management Accountant (CMA)

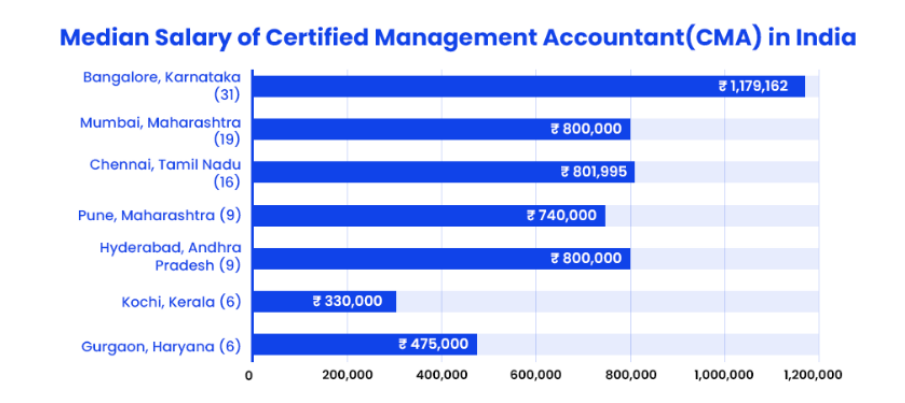

For individuals who have earned a Master of Business Administration and have an interest in management accounting, pursuing a Certified Management Accountant (CMA) program is a valuable next step.

This prestigious program, offered by the Institute of Certified Management Accountants (ICMA), is recognized worldwide and spans three years. It provides a thorough education in management accounting principles and practices.

An MBA background equips students with a solid foundation in business management concepts, which is highly advantageous for success in the CMA program.

The CMA curriculum is designed to focus on critical areas such as management accounting, strategic management, performance management, and risk management, all of which are essential skills for professionals in the competitive finance and accounting industry.

Holding both an MBA and a CMA certification reflects a high level of expertise in financial decision-making and strategic account management.

CMAs are skilled at analyzing financial data to assist organizations in enhancing performance, reducing costs, and maximizing profits. They handle responsibilities like budgeting, forecasting, and risk management to support effective strategic planning and execution.

After completing the CMA program, graduates can advance to top leadership positions within the finance and accounting sectors. The global recognition of the CMA certification offers career opportunities in both Indian and international business environments.

Job Profiles

After completing this degree, some of the best employment options are –

| Job Roles | Average Salary |

| Chief Financial Officer | INR 20.50 LPA |

| Corporate Controller | INR 9.50 LPA |

| Finance Manager | INR 17.00 LPA |

| Internal Auditor | INR 10.20 LPA |

6) Post Graduate Diploma in Computer Applications (PGDCA)

Pursuing a Postgraduate Diploma in Computer Applications (PGDCA) after earning a Master of Business Administration (MBA) is a strategic way to merge business management expertise with advanced computer skills.

This 12-month program provides a comprehensive overview of computer applications, including programming, software development, database management, and information technology.

In today’s technology-driven business environment, the combination of an MBA with a PGDCA equips students with a versatile skill set that is highly sought after for various managerial functions.

This program bridges the gap between technology and business objectives, preparing graduates for leadership roles not only in traditional business sectors but also in tech-focused industries like IT consulting, fintech, e-commerce, and software development.

After completing the PGDCA, students are well-positioned for a range of career opportunities in the tech-driven business world, enabling them to pursue top managerial positions within the technology sector.

Job Roles

Following their completion of a Post Graduate Diploma in Computer Applications, students often express a preference for the following positions:

| Job Roles | Average Salary |

| IT Project Manager | INR 17.00 LPA |

| Database Administrator | INR 8.50 LPA |

| System Analyst | INR 8.75 LPA |

| IT Consultant | INR 11.00 LPA |

7) Project Management Professional (PMP)

After earning an MBA, obtaining the Project Management Professional certification is a sophisticated step to improve job advancement and reputation in the project management industry.

The curriculum lasts for three to six months. The PMP certification adds to the solid groundwork of business management that the MBA program provides by showcasing the student’s particular skill in project management.

Having both an MBA and a PMP certification demonstrates a wide skill set that is highly valued in today’s competitive work market. An MBA gives students the strategic business knowledge they need to lead effectively across a wide range of functional areas in a company organization.

In contrast, the PMP certification emphasizes students’ understanding of project management methodologies, tools, and techniques in addition to their ability to effectively initiate, plan, execute, supervise, manage, and close down projects.

This dual qualification opens up a wide range of career choices in industries like IT, construction, healthcare, finance, and manufacturing.

An MBA graduate’s career is given a competitive advantage by this degree, which equips them for success in the workplace.

Job Profiles

Following their completion of the Project Management Professional program, MBA graduates often express a preference for the following positions:

| Job Profiles | Average Salary |

| Project Manager | INR 17.25 LPA |

| Project Coordinator | INR 5.50 LPA |

| Process consultant | INR 7.85 LPA |

| Project Scheduler | INR 8.50 LPA |

8) Postgraduate Diploma In Marketing Management

Pursuing a Postgraduate Diploma in Marketing Management after completing a Master of Business Administration can be a beneficial step for students seeking specialized knowledge and skills in marketing.

This is a 2-year PG diploma program extensively covering marketing management principles and practices, enhancing the competitiveness of students aiming for a career transition into marketing roles and growth within the field.

New trends and technological advancements are constantly occurring in the dynamic and ever-evolving industry of marketing. With the most recent developments in consumer behavior, digital marketing, analytics, and other fields, a postgraduate diploma in marketing management keeps students competitive and relevant in the workplace.

Among the most industry-relevant subjects taught by this program’s curriculum are market research, consumer behavior, branding, advertising, digital marketing, strategic marketing management, and international marketing.

While studying this program, students can also investigate subjects including data analytics, social media marketing, and marketing communications.

After completing this degree, students are equipped to take on leadership roles in a variety of businesses, including digital marketing firms, sales, retail, public relations, and advertising. This gives them the chance to transition from other professions into the marketing industry.

Job Roles

Following the completion of the PG Diploma in Marketing Management, the following are some of the highly desired job roles:

| Job Roles | Average Salary |

| Brand Manager | INR 15.84 LPA |

| Marketing Manager | INR 14.45 LPA |

| Marketing Specialist | INR 7.60 LPA |

| Social Media Manager | INR 8.50 LPA |

9) PG Diploma in Digital Marketing

To increase their relevance in the digital marketplace, pursuing a Postgraduate Diploma in Digital Marketing following the completion of a Master of Business Administration is a calculated move.

The growth of most corporate organizations nowadays is mostly based on their digital marketing staff. Digital marketing is likened to a car’s wheels, without which it is immobile.

Given the significance of digital marketing in corporate settings, students’ resumes will be strengthened by taking a postgraduate diploma in digital marketing following an MBA.

Pupils will be able to develop their skills. This will provide access to a variety of professional options, particularly for students who have finished their marketing concentration. Possessing in-depth understanding and proficiency in digital marketing, they can excel in their careers.

MBA graduates who are unable to join this program in regular mode can join the Online PG Diploma in Digital Marketing to grasp the same level of expertise in the domain with much more flexibility and time management.

Job Roles

Below are some of the best jobs in digital marketing that are currently available:

| Job Roles | Average Salary |

| Brand Manager | INR 15.84 LPA |

| Marketing Manager | INR 14.45 LPA |

| Marketing Specialist | INR 7.60 LPA |

| Social Media Manager | INR 8.50 LPA |

10) Financial Risk Management (FRM)

Finance is an important component of business organizations, crucial for the continuous functioning of their operations. Numerous risks and uncertainties are attached to finance.

As a result, there is a great need for qualified individuals who can manage these financial risks. The Financial Risk Management (FRM) program after the MBA program equips students with comprehensive knowledge of financial instruments, market dynamics, and strategic analysis of business finance.

This certificate program focuses on identifying, assessing, and mitigating various financial risks.

While pursuing this program, students develop abilities to formulate risk management strategies designed for specific industries, organizations, and market conditions.

This keeps them safe from possible losses and guarantees the best possible distribution of resources. With their quantitative and qualitative knowledge and expertise in financial risk management, they can design well-structured models to predict market trends, evaluate credit risks, and manage investment portfolios.

With a background in business management from an MBA, this program offers a wide range of career opportunities to students, shaping their future in the finance industry.

With communication and leadership abilities from an MBA, students pursuing a Financial Risk Management program can collaborate with various industry leaders to develop risk management strategies.After completing this program, students will advance to new professional levels.

Job Role

Below are some of the best jobs in digital marketing that are currently available:

| Job Roles | Average Salary |

| Financial Risk Manager | INR 9.2 LPA |

| Financial Risk Analyst | INR 6.5 LPA |

| Portfolio Manager | INR 15.00 LPA |

| Financial Adviser | INR 7.10 LPA |

Conclusion :

In conclusion, pursuing these courses after completing a Master of Business Administration ( MBA )will provide a significant advantage in their professional careers. They can enhance their skills and expertise to stay competitive in the industry, leading to potential promotions and appraisals.

FAQs

Q1 – Why is there a need for additional courses after an MBA?

Ans. The necessity for further programs stems from the ever-evolving business landscape. To stay abreast of the latest industry developments, you must acquire relevant and updated knowledge and expertise. Without pursuing courses to enhance your understanding, you risk becoming irrelevant in the industry.

Q2 – Who can pursue a DBA program?

Ans. Students with a master’s degree in any discipline and 2 to 5 years of work experience are eligible for the Doctorate of Business Administration (DBA) Program. Typically, senior executives and CEOs of business organizations pursue this program. Students can enroll in regular or online modes.

Q3 – Which is better: PhD in Management or Doctorate of Business Administration?

Ans. Both programs are excellent for doctoral degrees in Management but differ in the nature of knowledge they offer. A PhD in Management focuses on theoretical knowledge applicable to academic research, while a DBA emphasizes practical aspects of management that address real-world business challenges.

Q4 – Must I quit my work in order to pursue an Executive MBA?

Ans. No, you do not have to leave your job to pursue an Executive MBA. The Executive MBA program is designed for working professionals with significant experience who wish to enhance their expertise in business management and administration. Online Executive MBA programs offer the flexibility to balance academic learning and professional responsibilities.

Q5 – What are the best courses I should take after earning my MBA?

Ans. A wide range of courses are available after completing an MBA. You can consider advanced programs like Executive MBA, Doctorate of Business Administration (DBA), PhD in Management, CMA, CFA, and more. These programs help upgrade your knowledge and skills, ensuring you remain relevant in the industry.